Engagement and Retention

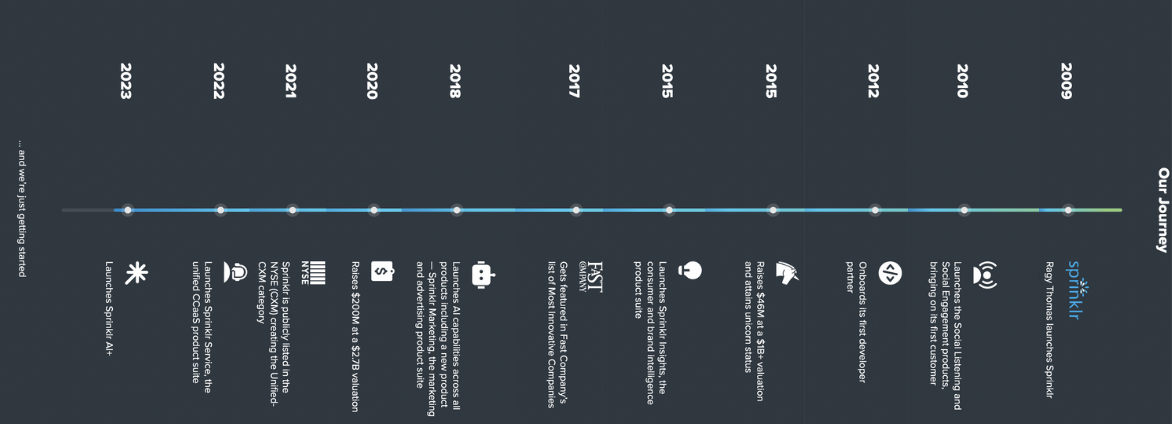

Company Overview: Sprinklr, Inc. is a 15-year-old B2B SaaS company that went public at NYSE in 2019. It was founded by Ragy Thomas. Sprinklr markets itself as a Unified-CXM platform for all client-facing operations. Sprinklr serves 2000+ brands that purchase some or all of the solutions.

Headquartered in NYC with over 2,400 employees globally, Sprinklr works with global brands like Microsoft, P&G, Samsung and more than 50% of the Fortune 100.

Renowned Logos Acquired:

Sprinklr's Way into Unified CXM

UNDERSTAND AND DEFINE

Core Value Proposition | Sprinklr:

The core value proposition of Sprinklr to its enterprise customers is to provide a Unified Customer Experience Management platform. Sprinklr consolidates listening and insights, social media management, campaign lifecycle management and customer service in one unified platform.

Unified CXM Platform: A unified workspace for front-office teams, providing a true omnichannel customer experience engine with centralized governance across various markets and business units.

Next Proprietary Gen AI: Customized AI models, augmented by generative AI and enriched by five years of annotation, optimization, and feedback built on the back of customer experience data.

Enterprise-grade solutions for all team sizes: A proven track record of success with the world’s largest enterprises powered by rapid innovation, extensive customisability and seamless integrations with third-party tools and systems.

Solves for core business needs: As a marketing, advertising, analytics and customer service platform, Sprinklr helps bring the four main tenets of the business together, helping the business create more awareness, attract more customers and keep existing customers coming back.

The Sprinklr APIs: Users with existing solutions can bring them all into Sprinklr through API. This eases conversion and retention efforts as users need not change their existing software solution habits to be a Sprinklr customer.

Products and Solutions that created the CXM Bundle | Sprinklr:

OFFERINGS:

Sprinklr has a horizontal CXM layer and vertical layer of products for marketing, advertising, customer service and social analytics/insights.

The software is offered in cost per seat per month basis for SMEs and startups for self-serve. The enterprises are given a custom pricing based on team size, product suites, features bought and product integrations required.

ENGAGEMENT:

Value Generation with Sprinklr:

Typical user starts off by establishing habit with using one product, mostly likely the marketing tool and eventually moves to other products. With Sprinklr, the real value of the tool is when the user has adopted a breadth of different products.

Depth as an engagement metric is relevant for a single product. But the true value of a CXM product like Sprinklr is on how well the tool is integrated within all relevant workflows of the company.

SEGMENTATION:

By ICP and stage of the company:

Segmentation | Individual and Early | Mid Stage Companies | Enterprises |

|---|---|---|---|

Role | Marketing Manager/ | Social Media Manager/ | VP/Director of PR/ |

No. of | 100-1000 customers | 1000-5000 customers | 5000+ customers |

Age of | 0-5 years | 0-5 years | 5+ years |

Current | Unstructured marketing | Need for a feasible | High CPA, Low ROAS, Lack |

Priorities | Grow Business | Acquire, engage | Convert leads, |

Current | Khoros, Meltwater, | Native channels, | Zoho Social, |

Decision to | Price Sensitive | Return on Investment | Scale, Reliability, |

Sprinklr | Sprinklr Advertising | Sprinklr Ads, Insights | Upto 3 or all 4 suites |

Sprinklr Plan | Self-serve | Depends on team size | Custom |

#Seats | 1-25 | 25-100 | 100+ |

Core Action | Launch | Manage campaign |

|

LTV | Low | Mid | High |

New Users | upto 5 seats/month | 5-25 seats/month | 25+ seats/month |

Sprinklr Features | Campaign Builder | Strategy Groups | Live Chats |

Products Used | Analytics tools | SFDC, PowerBi, | Analytics tools Salesforce, Oracle, Data Visualisation tools |

Average Product and Feature Adoption Score | Typically high due to | Good adoption | Moderate (Due to multiple teams, agency influence, relationship disconnect with some BUs of the enterprise and larger user base to convince for adoption) |

Product Retention | Product Switch is easier | Product switch | Retention is longer. Once the tool is selected, it is very difficult to switch out |

JTBD with Sprinklr | Launch paid and organic | Optimise omni-channel | Single tool to manage marketing, ads, support requirements for the company |

By features used

Step 1: Identify list of features and the natural frequency

To arrive at how engaged users are with Sprinklr, let’s look at different features present and what their natural frequency looks like

Feature | Product | Natural Frequency | Defining 'Usage' |

|---|---|---|---|

Editorial | Sprinklr Marketing | Daily | Viewed scheduled messages/ |

Request | Sprinklr Marketing | 2-3 times/week | Sent a content ideation |

Email | Sprinklr Marketing | Weekly | Plan email content, |

Custom | Sprinklr Marketing | Monthly | Create tags for assets/audience/ |

Social | Sprinklr Marketing | Daily/Weekly | Build widgets to report on organic |

Smart | Sprinklr Advertising | Quarterly | Build a quarterly |

Auto- | Sprinklr Advertising | Weekly | Boost best-performing |

Tiered | Sprinklr Advertising | Daily | Get mandatory approvals |

Ads | Sprinklr Advertising | Daily/Weekly | Build omni-channel ads |

Pacing | Sprinklr Advertising | Daily | Monitor campaign pacing |

Display and | Sprinklr Insights | Weekly | Curate fan content and |

Listening | Sprinklr Insights | Monthly | Build queries using |

Automated | Sprinklr Insights | Weekly | Schedule newsletter |

Benchmarking | Sprinklr Insights | 2-3 times/week | Measure social performance |

Product | Sprinklr Insights | Daily | Receive SKU-level/ |

Voice | Sprinklr Services | Daily | Deliver immediate, seamless service |

Live Chat | Sprinklr Services | Monthly | Create chat/web messaging |

Assignment | Sprinklr Services | Daily | Automatically route the |

Contact | Sprinklr Services | Quarterly | Identify agent-wise areas of improvement |

Case | Sprinklr Services | Daily | Create manage and |

Step 2: Define what constitutes core action

With the list of features that we have identified, let us now map which of these features contribute to solving for user’s JTBD

Feature | Product | Defining 'Usage' | Solves for |

|---|---|---|---|

Editorial | Sprinklr Marketing | Viewed scheduled | High |

Request | Sprinklr Marketing | Sent a content ideation | Medium |

Email | Sprinklr Marketing | Plan email content, | High |

Custom | Sprinklr Marketing | Create tags for | Low |

Social | Sprinklr Marketing | Build widgets to | High |

Smart | Sprinklr Advertising | Build a quarterly | High |

Auto- | Sprinklr Advertising | Boost best-performing | Medium |

Tiered | Sprinklr Advertising | Get mandatory approvals | High |

Ads | Sprinklr Advertising | Build omni-channel ads | High |

Pacing | Sprinklr Advertising | Monitor campaign pacing | High |

Display and | Sprinklr Insights | Curate fan content and | Low |

Listening | Sprinklr Insights | Build queries using | High |

Automated | Sprinklr Insights | Schedule newsletter | Medium |

Benchmarking | Sprinklr Insights | Measure social performance | High |

Product | Sprinklr Insights | Receive SKU-level/ | Medium |

Voice | Sprinklr Services | Deliver immediate, | High |

Live Chat | Sprinklr Services | Create chat/web messaging | Medium |

Assignment | Sprinklr Services | Automatically route the | High |

Contact | Sprinklr Services | Identify agent-wise | Medium |

Case | Sprinklr Services | Create manage and | High |

Step 3: Correlation of feature used vs. retention:

For a CXM product like Sprinklr, more the features used, higher the lock-in created with the platform, thereby lower churn. In order to determine what breadth of usage Sprinklr should encourage users to retain, we can plot how feature usage correlates to revenue retention.

Number of feature used

- Cohort users by number of core actions performed - 1, 2, 3, 4 etc

- Plot correlation to long term retention

- e.g customer who uses 2 features contribute to higher retention than customers who use only 1 feature

- Look for deflection points on where the delta of increased retention is higher

- e.g if increase in retention percentage from the 2 feature cohort to 3 feature cohort is lower than that of 1 to 2, we can conclude that 2 features is a sweet spot

- e.g if increase in retention percentage from the 2 feature cohort to 3 feature cohort is lower than that of 1 to 2, we can conclude that 2 features is a sweet spot

Which feature was used

- Cohort users by feature 1, feature 2, feature 3, used within 30 days of signup

- Plot correlation to long term revenue retention with high cash sales

- e.g customer who uses auto-boosting within 2 weeks of signup, contributes to higher retention than a customer who uses reporting tools within 2 weeks of sign-up

Defining casual, core, power users based on features used

For a CXM product like Sprinklr, it is important to drive Sprinklr’s users to Use a wide range of features from multiple product bundles

- Why Range of features is important?

- Using more number of features solves for the JTBD that the user came to Sprinklr for.

- Why Features from different bundles is important?

- A user using features from marketing, ads, insights and support bundles would mean that cross-team usecases and workflows within the company are moving to Sprinklr. This helps Sprinklr expand into the company and increase revenue

- Users realise the value proposition of a unified CXM tool vs a standalone set of different products, eventually consolidating different tools to a single platform like Sprinklrt. This consolidation is key to create lock-in, increase switching costs and reduce churn

Hence our customer segmentation of casual, core, power should capture these key drivers:

- Casual accounts: Uses 3 key features from marketing/ads suite 1 to 2 times in a week

- Core accounts: Uses 4 to 8 features from marketing/ads suite AND insights suite 3 to 7 times a week

- Power accounts: Uses 8+ features from marketing/ads suite AND uses 8+ features from insights suite AND uses 4+ features from service suite

| Casual accounts | Core accounts | Power accounts |

|---|---|---|---|

Metric | Uses 3 key features | Uses 4 to 8 features | Uses 8+ features |

Frequency | 1-2 times a week | 3-7 times a week | 10+ times a week |

Days Active in | 2-4 days/month | 10-15 days/month | 20+ days/month |

Products Used | Uses utmost 2 suites: | Uses Ads/Marketing with | Uses 3 or all 4 |

Stage of | Very early stage of | Finished trial/started with | Seats locked across BUs + success/ |

Features Used | Uses Sprinklr for basic | Uses Sprinklr for | Uses Sprinklr for strategy groups, |

Advance Segmentation:

| New User | Hibernation | In Danger |

|---|---|---|---|

Frequency of | Once in 15 days | Once in 30 days | Once in 3 weeks |

Recency of | <30 days | 30 days and | 15 days |

Last Used | This month | Last month | This fortnight |

Revenue | NA | Neglible | Low |

Products Used | 1-2 suites | 1 suite | 1-2 suites |

Top | Campaign | Reporting | Campaign |

User Bucket | Casual | Critical | Critical |

| Cannot Lose | Champions | Loyalists |

|---|---|---|---|

Frequency of | 3-7 times/week | Daily | Multiple times |

Recency of | 10 days | 1 week | 2 days |

Last Used | This week | Today | Today |

Revenue | Mid | High | High |

Products Used | 1-2 suites | 2-3 suites | 3-4 suites |

Top | +Optimisation | +Listening tools, | +DIT/DVT, |

User Bucket | Core | Power | Power |

ENGAGEMENT FRAMEWORK

| Tracked By | Relevance | Comments |

|---|---|---|---|

Breadth | Number of different | Primary | For a CXM suite with a wide When the user uses more features, |

Frequency | Number of times | Secondary | Number of times the feature |

Depth | Time spent | No | Depth of usage is important |

ENGAGEMENT CAMPAIGNS:

CAMPAIGN 1:

Goal | Movement from Core to Power users |

|---|---|

User Segmentation | Users of ads/marketing suites from self-serve offferings |

Hypothesis | Mundane and complicated tasks for not-so-tech-savvy users |

Pitch | Use gamification to increase in-app engagement |

Campaign Details | Progress bars and checklists: Provide a sense of accomplishment. |

Offer | Enhanced hyperspace with gamified UX |

Frequency | One-time platform revamp for continued benefits |

Success Metrics | Increased activation rate, higher CSAT, increased retention and LTV |

CAMPAIGN 2:

Goal | Movement from Free Trial to Paid Subscription |

|---|---|

User Segmentation | Users of all product suites who lack product specialists in free trials |

Hypothesis | Users get stuck in a complicated feature and fail to adopt, there's no personalised nudge or monitoring to engage more |

Pitch | Publish context-based in-product messaging |

Campaign Details |

|

Offer | Immediate and context-based personalized message based on the specific UI element that a user is interacting with |

Frequency | To be sent multiple times a day to casual users, it is important that the frequency does not become too nudgy that the campaign backfires |

Success Metrics | Onboaring Completion Rates, Survey Response Rates, |

CAMPAIGN 3:

Goal | Movement from Casual to Core |

|---|---|

User Segmentation | Remote BUs in enterprise subscriptions that need tool re-call |

Hypothesis | Enterprise users who do not participate in VRCIs are unaware of the latest product capabilites and current use cases served by their license |

Pitch | Re-engage casual users with email marketing |

Campaign Details | E-mail marketing is a great tool to nudge the user to engage and

|

Offer | Re-initiate key value-based actions on the platform through e-mail marketing |

Frequency | Weekly and monthly emails fequency can be hyper-customised as per categories of current engagement within our user segment |

Success Metrics | Click-through-rate, Open Rate, Unsubscribe Rate, Email Forwarding Rate |

CAMPAIGN 4:

Goal | Movement from Casual to Core |

|---|---|

User Segmentation | Users with success packages who are new to CXM/CRM tools |

Hypothesis | Training gaps cause friction during engagement efforts, users are impatient and need proactive care |

Pitch | Deploy proactive support and platform education with a knowledge portal |

Campaign Details |

Choosing the Right Training Calendar Schedule: Track and Analyse Program Performance and Engagement: Ongoing Support and Continuous Learning: |

Offer | Anticipate customer issues and deploy a continued user training program |

Frequency | Weekly office hours, monthly feature walkthrough lives, daily engagement with dedicated Sprinklr product success experts and 24x7 support team access, one-time set-up of resource centre |

Success Metrics | Decreased customer support requests, Improved Product/Feature Adoption Index, Improved CSAT and CHI scores |

CAMPAIGN 5:

Goal | Casual to Core to Power, Trial to Paid |

|---|---|

User Segmentation | Mix of trial, dormant, occasional, active, power and champion users across product suites for effective product usage analytics experiment |

Hypothesis | Success managers are unable to find the low-hanging fruits to move users up the engagement ladder, they lack data-driven approach |

Pitch | Software Usage Analytics to gain actionable insights on engagement whitespaces |

Campaign Details | Software usage analytics empowers product managers with data-driven insights for decision-making. To measure product usage data: One way to leverage event tracking is to optimize the user journey inside the product. To do so, you need to identify the key actions that indicate that the user has progressed to the next stage. In-app surveys are easy to create and you can use trigger them for specific user segments at a specific time We can then tweak the in-app onboarding flows to guide users with similar use cases along the most optimal paths and increase their activation and adoption rates. |

Offer | Track individual actions/custom events by monitoring user interaction with the platform and its capabilities |

Frequency | To be tracked and analysed daily, to be shared for action plan on a weekly/bi-weekly basis |

Success Metrics | Increased conversions at prominent customer journey stages and lowered Time To Value, Improved Trial Conversion Rate |

RETENTION AND CHURN

Visualising Retention Curve for Sprinklr

There's not enough internally circulated data on how the retention curve for Sprinklr looks like.

I have made my hypothesis on how it might look like.

Measuring 180 days retention of different segments:

- Casual: 15% retention in 180 days and flattens after this

- Core: 40% retention in 180 days and flattens after this

- Power: 65% retention in 180 days and flattens after this

Who drives retention?

| Early Stage | Mid-stage | Mature |

|---|---|---|---|

RETENTION | Low | Mid to High | High |

Price | High | Medium | Low |

ICP Needs | Cannot afford | Can afford basic | Will opt for premium |

Company | High Threat | Medium Threat | Low Threat |

Correlation to | High chance of | Lower chance to churn if | Low risk to churn. Dedicated |

Switching | Low switching costs | Mid switching costs | High switching costs that act |

Products | Self-serve - | Marketing+Ads+Insights/ | >2-3 Product Suites |

Goals | Maintain active usage | Maintain active usage | Ensure company is fully |

Defining Churn:

In Sprinklr, churn can be defined as an activated account that is currently dormant for a considerable amount of time or has shown strong signals to cancel the renewal of their contract license.

Soft Signals:

Dip in engagement and user moving from one segment to another

- Moves from Champions and Loyalists to Can’t lose them segment

- Moves from Can’t lose them segment to in danger segment

Hard Signals/Negative Actions:

- Remove funding instrument

- Fail to re-add deactivated accounts/audiences/assets

- Switching off contract auto-renewal

- End recurring VRCIs and cadences with product success experts

- Increased number of support tickets around billing, renewals and cancellations

- Delete product integrations

- Reduce no. of seats in the subscription

- Low CSAT, CHI and NPS scores

- Does not actively look out for product releases

- Pause scheduled report exports

- Agency/specific BUs offboarded

- C-suite/decision makers refusing to participate in EBRs/QBRs

Top reasons for churn:

RESURRECTION CAMPAIGNS:

CAMPAIGN 1:

Segment | Dormant/Casual User - practitioner level |

|---|---|

Reasons for Dormancy | Training gaps, did not know how to leverage the platform, |

Signals to Watch for | User started actively but no movement after |

Theme | End-to-end user training calendar |

Campaign Details |

|

Offer | Book a slot with your Product Success Manager to |

Frequency | Office hours (weekly), VRCIs (bi-weekly), |

Success Metrics | Spike in dormant to casual user conversion rate, |

CAMPAIGN 2:

Segment | Champion/Loyalists - Core/Power User |

|---|---|

Reasons for Dormancy | User failed to convince the decision maker/blocker to |

Signals to Watch for | Users' core action reduced around the time of renewal, |

Theme | Value Realisation Dashboard, potential ROI boost Pitch |

Campaign Details | Value Realisation Dashboard: These dashboards are built to Executive Business Reviews: These reviews are held during Quarterly Board Reviews: |

Offer | Executive Business Review with decision makers |

Frequency | Once 90 days before renewal, once 30 days before renewal |

Success Metrics | Movement from decision to logo churn to final call to partial churn, |

CAMPAIGN 3:

Segment | Decision Maker/BU Heads |

|---|---|

Reasons for Dormancy | Brand found an alternate product for their JTBD |

Signals to Watch for | Reduction in user seats, failed product enhancement requests, |

Theme | Competitor Battlecards, option to pause license, price discounts |

Campaign Details | |

Offer | Pause subscription and retain data for 6 months (demo period |

Frequency | One-time offer to pause, monthly organic nudge via battlecards, |

Success Metrics | Opt resume of contract before pause period ends, |

CAMPAIGN 4:

Segment | Practioner - Casual, Core and Power Users |

|---|---|

Reasons for Dormancy | Frequent product bugs and missing features |

Signals to Watch for | Increased escalated support tickets, low interest in |

Theme | Product Enhancement Request Prioritisation, |

Campaign Details | Product Enhancement Request Prioritisation: Product gaps, On-time Product Release Updates : Product releases keep Grievance Redressal via Seat Discounts If any brand's |

Offer | We've heard you. Our product team is actively working to |

Frequency | Quarterly product release and enhancements, ad-hoc discounts |

Success Metrics | Number of sales meetings the account manager has with the client |

CAMPAIGN 5:

Segment | CXO, VPs, Directors and other primary decision makers |

|---|---|

Reasons for Dormancy | No need for the Sprinklr solution due to |

Signals to Watch for | Noticeable negative actions after major company announcements, |

Theme | Offer product suite switch/propose level down instead of full churn |

Campaign Details | Offer Product Suite Switch: If the brand does not need the |

Offer | We have an offer for you! Switch suites and bring down your costs |

Frequency | One-time around renewal or as and when major |

Success Metrics | Opt to switch suites, # predicted logo churns that |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.